How HODLing is losing you money (Crypto)

How HODLing is losing you money :

Many cryptocurrency investors are in love with buying an asset and holding it until who knows when. Buy and forget has never been an investment strategy anyway. It was what your grandma or grandpa would have done who knew nothing about investments. We have already introduced a bulletproof investment strategy in this post. The strategy is quite simple to follow and only needs the investor to be disciplined.

Why this strategy works

There are two principles any investor should have in mind: a. you never know when an upward trend ends and a downward one starts, and b. you never know when a downward trend ends and an upward one starts. Even technical analysis only offers indications, not actionable predictions.

This strategy builds exactly on those two principles. It forces the investor to withdraw some of the unrealized profits by selling units, and to grab the opportunity of discounted valuation compared to the original investment price per unit, buy buying the (relative) dips.

This leads to lower profitability, in one hand (often, realized though - as if the original investment has paid on itself), but on the other hand it's on the safer side, as it makes the original investment less expensive.

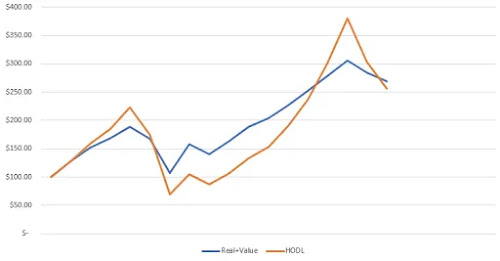

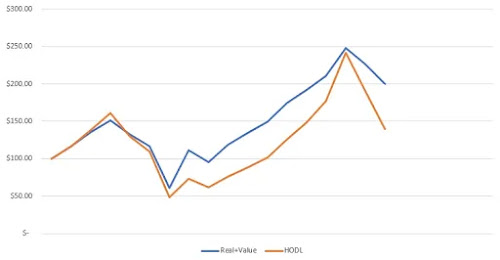

Although we knew this strategy to work theoretically, we decided to test it with two popular crypto assets: Ethereum and Basic Attention Token (BAT). The two assets have different volatility levels and currently offer very different ROI. The test starts with a $100 investment on January 1st, 2020 on both assets, and we compared ROI. Trading strategy is at +/-15% in asset valuation (balanced).

Ethereum :

BAT :

Where performance in ROI is seen better, is with less volatile assets. BAT is a great example. Light trading has been performing better almost since the third trade (note that ROI for the first trade after the original investment is identical), and the price volatility didn't allow HODLing strategy ROI to catch-up. Currently ROI difference among the two strategies is at 29.9%.

Trading strategy variations

As already mentioned, the above charts show balanced trading at +/-15%. You may modify the strategy to be more aggressive, by being more sensitive to bear market fluctuations (e.g. +20%/-10%), or more defensive, by being more sensitive to bull market fluctuations (e.g. +10%/-20%). The point in this strategy is to follow the limits, no matter what the market conditions are, and not to change the limits in response to market conditions.

An additional benefit of this strategy is that you always have available funds to finance future purchases, or take advantage of extreme downward fluctuations.

See other posts of my blog too! Keep supporting..

Comments

Post a Comment